2021 H1: Fraud risk at a glance

Consumers made it clear they don’t want to leave the convenience of online interactions behind. But as a new world of hybrid online/offline interactions begins to emerge, so do new threats and [...]

Use cases

Financial or eCommerce transactions attract creative cybercriminals that can bypass common security tools. But as you focus on how they act and how to block them, it is easy to forget about the experience for your real users.

Financial or eCommerce transactions attract creative cybercriminals that can bypass common security tools. But as you focus on how they act and how to block them, it is easy to forget about the experience for your real users.

One-time passwords (OTP), security questions and other verification tools like CAPTCHAs mean your real users must jump through hoops they shouldn’t have to. And yet, attacks such as card testing and fraudulent transfer or purchase continue to fool bot and device-based tools.

One-time passwords (OTP), security questions and other verification tools like CAPTCHAs mean your real users must jump through hoops they shouldn’t have to. And yet, attacks such as card testing and fraudulent transfer or purchase continue to fool bot and device-based tools.

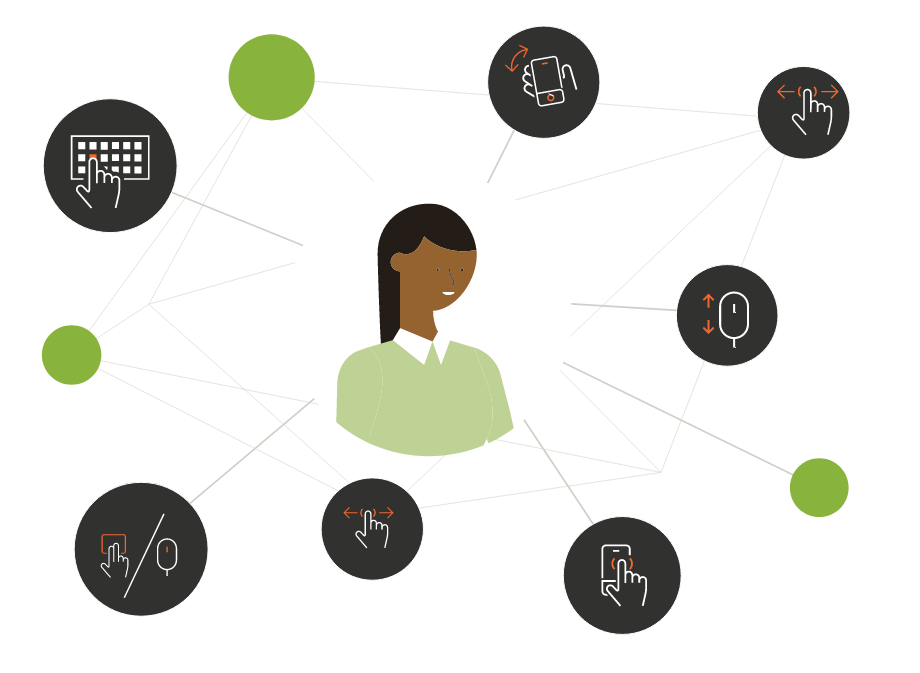

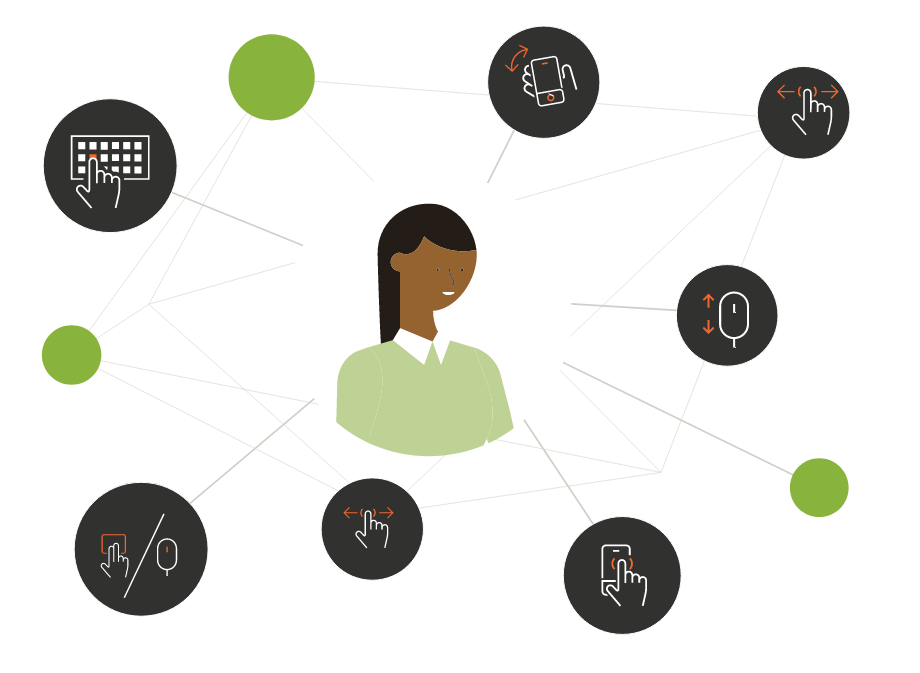

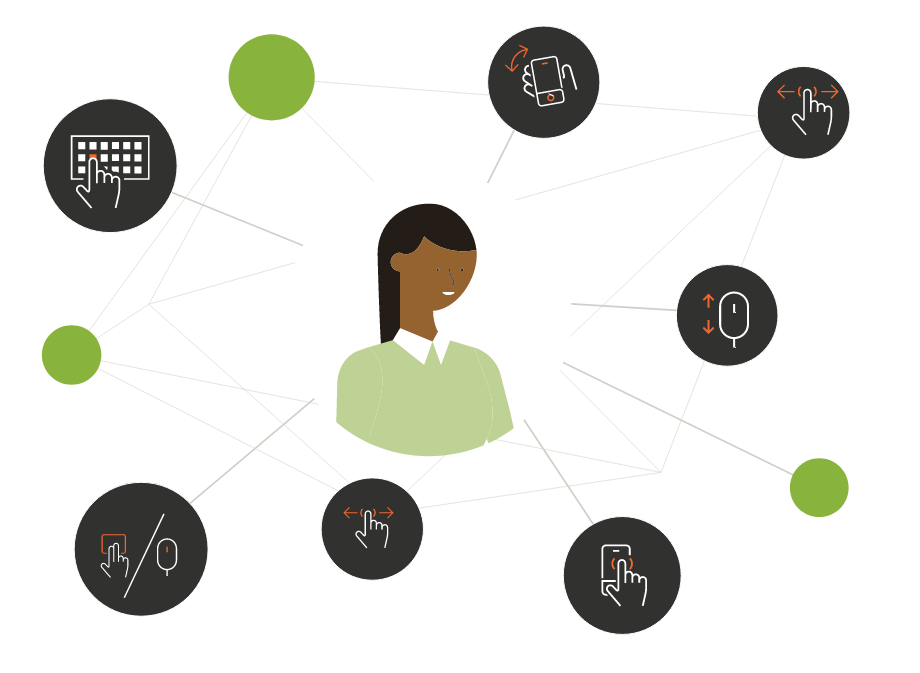

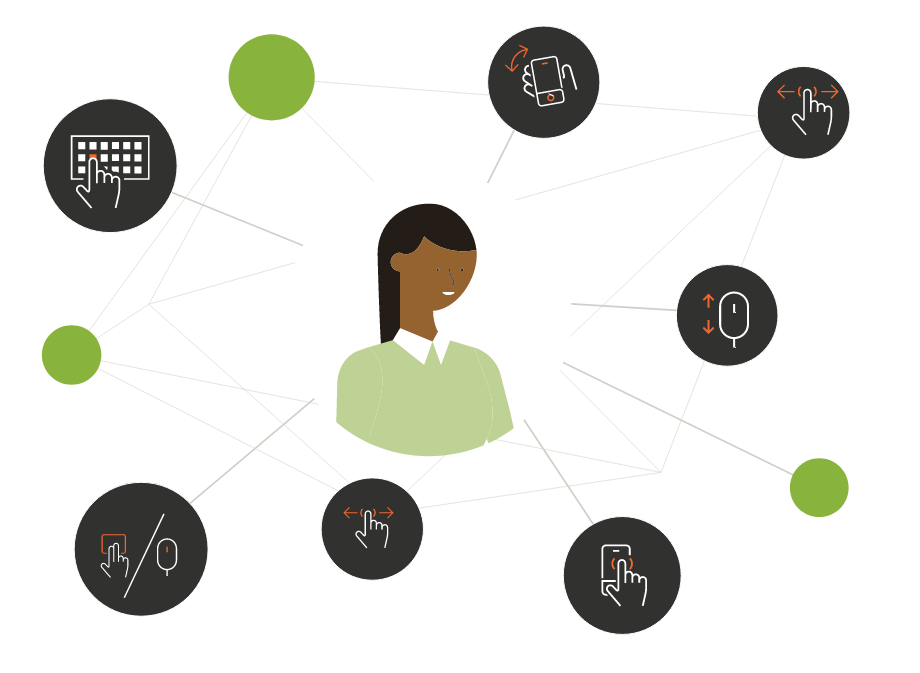

NuDetect uses behavioral and device insights to identify legitimate human users, reduce friction, and weed out fraudulent users. By looking at how a user behaves when they transact, companies can passively validate users beyond credentials and improve their experience – meaning cybercriminals suffer, not your customers.

NuDetect uses behavioral and device insights to identify legitimate human users, reduce friction, and weed out fraudulent users. By looking at how a user behaves when they transact, companies can passively validate users beyond credentials and improve their experience – meaning cybercriminals suffer, not your customers.