Trust the person

behind the device

Secure digital interactions with behavioral

and device insights

Trust the person behind the device

Secure digital interactions with behavioral and device insights

Trust the person

behind the device

Secure digital interactions with

behavioral and device insights

Security without

the friction

By leveraging our unique behavioral and device insights, you get better risk scores and improve your user experience from login to logout. It’s that simple.

Security without the friction

By leveraging our unique behavioral and device insights, you get better risk scores and improve your user experience from login to logout. It’s that simple.

A solution for every challenge

Results in numbers

+20B

risk assessments

every year

4.5B

devices monitored

every year

3.4B

accounts protected

every year

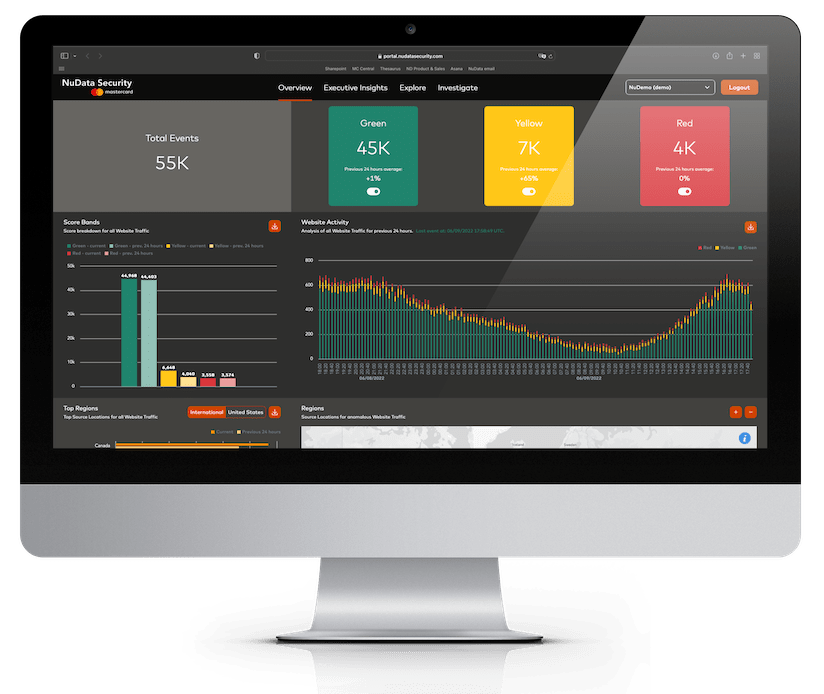

An unmatched product

NuDetect combines behavioral signals, device intelligence, and an unparalleled trust network to separate good from bad traffic passively and in real time.

An unmatched product

NuDetect combines behavioral signals, device intelligence, and an unparalleled trust network to separate good from bad traffic passively and in real time.